Slightly over a year ago, Patrick Mweheire was appointed CEO of Stanbic Bank Uganda, to become the first Ugandan to head the bank since Standard Bank, a South African financial services giant, took it over 15 years ago. On April 14, Mweheire, who presided over the presentation of the bank’s balance sheet to business journalists and investment firms in Kampala, cut the figure of a contented boss. He had a reason to be elated.

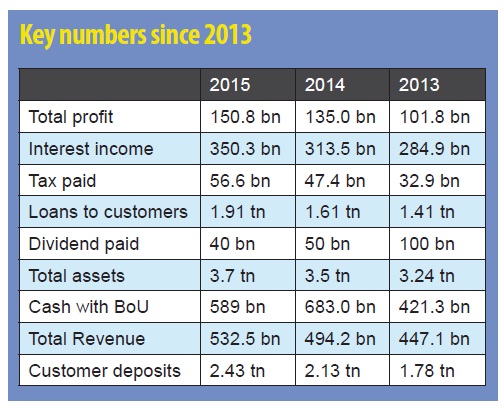

The bank announced a net profit of Shs 150.8 billion, up from Shs 135.0 billion in 2014. That is good performance but there is a concern – net profit grew by only Shs 15 billion in 2015 compared to Shs 33 billion in 2014, which implies that the bank was hit by a 100% decline in the rate of growth in profit. That does not make interesting reading but it is understandable given the context, which Mweheire described as a “challenging macro-economic environment.” In 2014, the shareholders received Shs 1.66 per share in dividends; this time it will be far lower – less than a shilling per share or 0.78 of a shilling to be precise. This was attributed to new rules that have been introduced by the regulator.

Mweheire said their “strong earnings of Shs 532.5 billion in 2015 were generated through a balanced mix of net interest income and non-interest revenue. But even this total revenue showed a lower rate of growth compared to 2014 and 2013.

However, despite the tough economic climate, Uganda’s largest bank by assets, grew its customer deposits to Shs 2.43 trillion from 2.13 trillion in 2014. Also, net interest income grew to Shs 311 bn in 2015 compared to Shs 280 bn in 2014 though net fees and commission income dropped to Shs 105 bn in 2015 from Shs 108 bn in 2014.

As at Dec.31 2015, the bank reported its cash balances with the BoU to have dipped from Shs 683 bn in 2014 to Shs 589 bn in 2015. It also saw an erosion on the government securities held for trading, which dropped by Shs 80 billion to Shs 177 bn in 2015.

But with the retained earnings increasing, and profit also growing, the shareholders can not complain too much given the state of economy, which has been hostile since 2009 when the global financial crisis took its toll on world economies.

Despite an erosion on government securities, Stanbic Bank grew its loan book, with lending and advances to other banks growing by Shs 78 billion, while loans to customers shot up to Shs 1.9 trillion in 2015 compared to Shs 1.61 trillion in 2014.

Financial analysts say the bank could have performed much better on growing its loan book even though high interest rates due to monetary policy tightening and tighter credit conditions due to shortage of long-term funds created a lower risk appetite and the need for commercial banks to reduce their exposure from large borrowers.

“Given Stanbic`s status and size, its performance is not the best. If you look at the profit of Shs 150 bn, it is not a big deal for a bank of its size, it should have made more than that,” an analyst said.

But like her peers, the bank had to grapple with a harsh economic situation.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price