Retirement benefits schemes contributed taxes amounting to UGX235 billion to the government in 2023, up from UGX227 billion in 2022.

✳ 10% increase in total pensions assets to sh22 trillion

✳ People saving for retirement, up from 3,015,807 to 3,142,311

✳ URBRA’s supervisory actions led to recovery of UGX 26 billion

✳ More employers making voluntary contributions from 273 in 2022 to 298 in 2023

✳ Retirement sector 60% of gross domestic savings, accounting for 11.5% of GDP

✳ Schemes paid up to UGX235 billion in taxes in 2023, up from UGX227 billion in 2022

Kampala, Uganda | THE INDEPENDENT | Uganda’s pension sector has registered a 10% increase in total assets in the last one year, reaching a new hight of sh22 trillion. The growth in sector assets was mainly a result of increased net contributions valued at sh700 billion and income generated from investments valued at sh1.3 trillion.

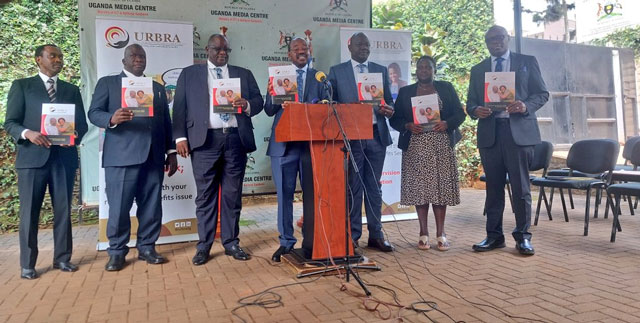

This was announced Thursday by Amos Lugoloobi, Minister of State for Planning as he released the Sector’s 2023 Annual Performance Report, published by the Uganda Retirement Benefits Regulatory Authority (URBRA).

Further growth was recorded in the number of people saving for retirement, which rose from 3,015,807 in 2022, to 3,142,311 in 2023, representing 15% coverage of Uganda’s total working population.

“The simple act of saving a portion of one’s income for retirement sets in motion a chain of decisions and actions that ultimately have a positive impact on the national economy. Saving for retirement is therefore a patriotic deed,” Minister Lugoloobi said, as he commended Ugandans who had embraced voluntary retirement saving in 2023.

He noted that currently, retirement savings account for 60% of Uganda’s Gross Domestic Savings, and 11.5 % of the Gross Domestic Product (GDP). Additionally, retirement benefits schemes contributed to the economic growth through the payment of taxes amounting to UGX235 billion to the government in taxes in 2023, up from UGX227 billion in 2022.

Explaining the key factors behind the 2023 sector performance, the CEO of URBRA, Martin Anthony Nsubuga cited the Regulator’s strict supervisory actions and increased compliance on the part of the regulated entities.

Key among the Regulator’s actions was the introduction of a Risk-Based Supervision system, which enables the Authority identify and address risks before they affect the ability of regulated entities to meet their obligations. The ultimate outcome is better protection of the savers’ funds.

Nsubuga also attributed the good performance to other factors that drive the sector saying, “governance, administrative and investment costs, density of contributions all come together to drive sector growth. Working at scheme level, we sought to identify and address weaknesses in risk management. In some instances, this included taking considered and proportionate enforcement action against some schemes and service providers.”

He reassured all sector players that going forward, URBRA would be quicker and bolder in the use of its powers, with an increased focus on scheme management and operation, where non-compliance could be an indicator of broader governance failings.

Apart from the key achievements, the report indicated that in 2023, the sector grappled with some concerns including governance and prudent management in some schemes, delayed remittances, delayed payment of benefits, non-compliance with supervisory directives, high operational costs and failure to comply with financial disclosure requirements.

Other concerns arise from the sector operating environment including the wider economic performance, inflation, foreign exchange rates, population trends, and employment rates. “These require the pensions sector to work collaboratively with other sectors. As a key player in the financial services sector, URBRA should constantly monitor the trends to see how they ultimately affect the savers’ retirement benefits,” Lugoloobi advised.

The Chairman URBRA Board of Directors, Julius Bigirwa Junjura drew attention to the main goal of the retirement benefits sector, which is to ensure that all Ugandans who retire don’t end up in old-age poverty.

“Retirement Benefit arrangements move resources obtained during work life to post-retirement when income is no longer obtainable. This implies that assessment of the sector must go beyond financial performance to cover the interests and rights of savers. Consistent remittance of contributions and timely payment of benefits must be emphasized,” Junjura said.

This clearly reflected URBRA’s key achievement in recovery of UGX26 billion, which would otherwise have been lost to unremitted contributions, delayed payout of benefits, and sometimes misappropriation of members’ funds.

RELATED STORIES

A regulated pensions environment breeds transparency and accountability

‘Africa running out of time to sort looming pensions crisis’

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price