Museveni badly needs $20bn for big projects, can his technocrats get it?

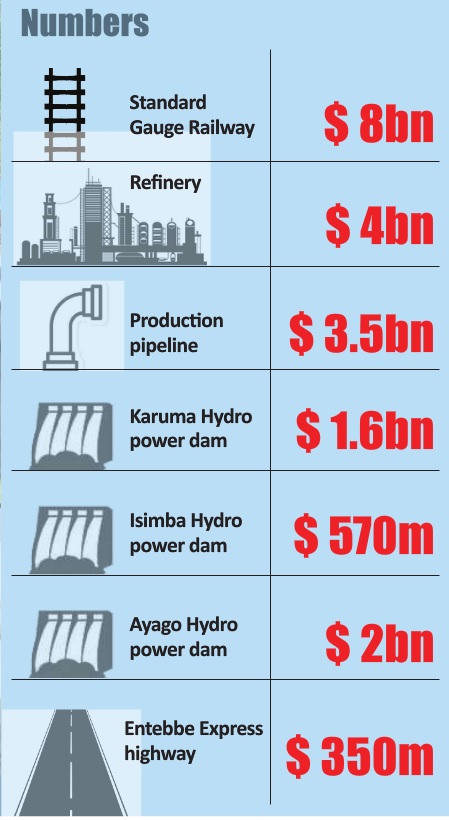

President Yoweri Museveni has set goals for his government to construct a number of mega projects requiring about US$20 billion to finance in four years up to 2020. Can he achieve them? The projects include key oil infrastructure, including an oil refinery and oil pipelines, and a Standard Gauge Railway (SGR), roads and other hydropower dams.

Already two major hydropower projects are under construction simultaneously together with several major new roads. Now The Independent has learnt that technocrats at the Finance Ministry are having a tough time convincing financiers to pick interest or commit to finance them.

Mid-last year, the International Monetary Fund (IMF) projected that Uganda needed $ 11 billion for a 10-year programme to overhaul its infrastructure. The figure has now been revised to over $ 20 billion by experts. That is approximately Shs66 trillion or twice the size of the current national annual budget, which is Shs26 trillion.

The granting recently of eight oil production licences to to Tullow Uganda Operations Pty Ltd and Total E&P Uganda B.V. was meant to draw the interest of investors who appeared to have lost interest because of the endless negotiations, insiders say.

Secretary to the Treasury, Keith Muhakani, has also led several trips to China to convince officials at the Exim Bank to finance some of these projects, including the SGR, but there has so far been no announcement of a breakthrough.

Details of Muhakanizi’s most recent trip remain scanty but according to insider sources optimism remains low especially given what financiers are committing and what is required to finance the lined up infrastructure projects.

The Chinese who have financed several projects in the past are said to be growing weary of lending more to Kampala. Their delay to commit has sparked speculations in Kampala that having lent quite a bit to Museveni’s government, the Chinese are worried about the government’s ability to repay the loans.

Uganda has borrowed some $ 350 million for the Entebbe Express Highway, $ 1.6 billion for the Karuma Hydropower Dam, and over $ 500 for the Isimba dam. Museveni now wants some $2.5 billion for a section of the SGR amongst others.

The government is urgently looking to implement the eastern route of SGR project—connecting from Kampala to Malaba, where it is intended to connect with the Kenyan route.

The leaders of Rwanda, Kenya and Uganda, launched the SGR in 2013 but while Kenya has completed over 80 percent of its part, Uganda is still lagging behind.

Uganda’s part of the railway, was expected to be completed in 2018, however, government was forced to revise the timelines for the completion of the project to 2020 because financial closure has delayed.

This is indirectly because of Kenya and directly because China’s Exim Bank, which was fronted by China Harbour, the contractor, as the financier, is also giving government a tough time.

According to some informed sources, the major concern for the Chinese, seems Kenya. Last year, a high ranking official in Kenya said the country could terminate the SGR at either Naivasha or Kisumu. When this year, Uganda chose the Tanzania route for the oil pipeline over the Kenyan route, much to the chagrin of the latter, reports of terminating the SGR at Kisumu surfaced again.

Indeed, during this year’s budget speech, Kasaija appeared to plead with the Kenyans. Kasaija said: “we congratulate of our brotherly Government of Kenya for the progress on construction of the Mombasa – Nairobi Standard Gauge railway now at 75% completion, and welcome plans to start construction of the Narobi-Kisumu-Malaba section. Our desire is to synchronise the completion of Malaba – Kampala Standard Gauge railway with the completion of the Kenya sections, in order to gain maximum benefits from these heavy investments.”

Whatever the case, according to insiders at the Finance Ministry, the Chinese bank that lends to Uganda has set tough loan preconditions. One of the preconditions was for the government to secure guarantees from Kenya that it is still interested in and willing to secure financing for the part that extends from Naivasha to Malaba.

The Chinese also demanded that government compensates the Project Affected Persons (PAPs), which requires some Shs.300 billion, part of which the government has already disbursed to the implementing agency. The other condition is that government carries out studies on the financial viability of the project.

The preconditions set by the Chinese contradict President Museveni’s praises of China as a friend and development partner that does not set conditions before lending like the West.

It is not the first time Chinese financiers are setting these sorts of conditions. The financial closure for Karuma and Isimba also delayed because the Exim Bank had set a number of conditions including that government first contributes and pays upfront 15 percent of the total cost of each of the dams.

President Museveni has also faced another headache with the Chinese contractors. Sinohydro, which was contracted to construct Karuma has come under fire over shoddy works during the construction. Officials at the Finance Ministry have also been forced to hold meetings with the Chinese contractors and Ugandan service providers to get them to subcontract local suppliers.

Apart from the SGR, oil infrastructure— refinery and attendant infrastructure, crude pipeline and products pipeline, roads and other hydropower dams like 850 MW Ayago dam, is also giving officials sleepless nights. For the oil infrastructure, the urgency is largely because of the tight timelines they have set within which the country should have started producing oil.

Oil infrastructure alone requires about $ 15 billion. This is required urgently especially if Uganda is to produce oil by 2020.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price