Banking entities posted impressive growth in profit after tax during the year owing to the opening up of the economy and the subsequent growth in the private sector credit

Kampala, Uganda | ISAAC KHISA | More than half of companies listed on the Uganda Securities Exchange recorded growth in profits in the last financial year, analysis by The Independent reveals.

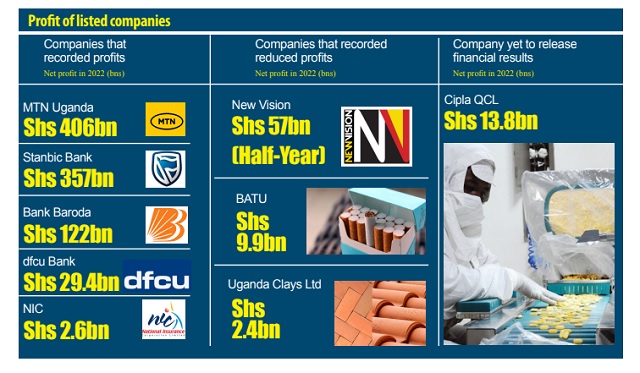

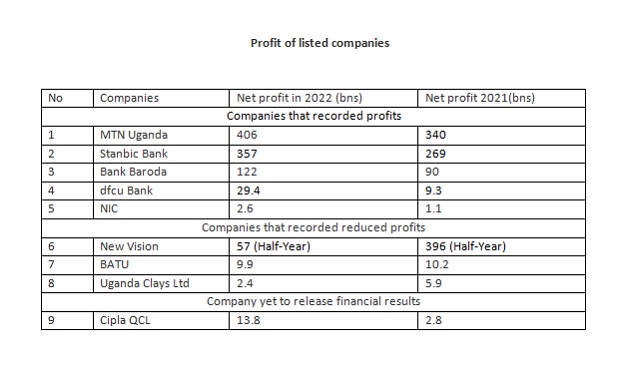

Five of the nine domestic companies that traded on the stock market recorded an increase in profits, three reduced profits and two yet to release their financial results.

Financial experts say the profitability of listed companies reflects the performance of the economy in the short and long term.

MTN Uganda, the first telco to list on the stock market was the most profitable company, recording a 19.3% growth in profit after tax to Shs 406.1bn citing growth in data and fintech services.

Data and fintech revenues grew by 24% and 24.9% to Shs511.3bn and Shs 656.1bn, respectively, on account of increased users. Voice revenues, though, contributed 44.2% to total service revenue, recorded a marginal decline of 0.5% during the period under review.

The banking entities posted impressive growth in profit after tax during the year owing to the opening up of the economy and the subsequent growth in the private sector credit.

Stanbic Bank recorded the largest growth in profit after tax, having increased from Shs 269bn in 2021 to Shs 357bn last year driven by both interest and non-interest income.

However, the lender’s costs of operation increased by 3% to Shs 495bn citing inflation during the period under review.

Bank of Baroda recorded an increase in profit after tax from Shs 90.23 bn to Shs 122.2bn in 2022 citing a robust system and standardized process.

Similarly, dfcu Bank recorded an increase in profit after tax from Shs 9.3bn to Shs 29.5bn citing automation and an increase in private sector credit growth. Also, the lender’s loan impairment reduced by 41% as customer deposits increased by 6%.

“We extended loans to more individuals and businesses across different customer segments, resulting in the growth of borrowers by 15%. We invested in Government Securities growing the portfolio by 63%, which is part of the focus to diversify the asset base,” the lender said in a statement.

The lender hopes to continue to execute its strategy anchored on ‘customer obsession’, and digital transformation whilst ‘transforming lives and businesses through innovative solutions and empowered people.’

Electricity distributor, Umeme, recorded a 6.5% growth in profit after tax last year to Shs148bn citing growth in new electricity connections and a reduction in energy losses.

Umeme registered 121,132 new connections during the year boosting its customer base to 1.75 million as the rate of revenue collection increased from 99.1 to 99.7% during the period under review.

Energy losses reduced from 17.8% to 16.8% on account of the re-opening of the economy and the restarting of field activities.

Reduced profitability

On the other hand, Uganda Clays, British American Tobacco and New Vision Printing and Publishing recorded reduced earnings.

The clays products manufacturer, Uganda Clays Ltd, recorded a sharp reduction in profit after tax from Shs 5.9bn to Shs 2.4bn citing supply chain disruptions and an increase in production costs during the period under review.

“Because of the dampened global economic environment, the company operated in challenging business conditions in 2022 that was characterized by high inflation and increased interest rates,” the company’s board chairman, Martin Kasekende and CEO Reuben Tumwebaze said in a joint statement.

“These factors increased the costs of production and dampened consumer demand and ultimately affected the profitability of the company. Despite these challenges, the company posted positive results.”

The New Vision Printing and Publishing Company recorded a fall in profits from Shs 396.5bn to Shs 57.3bn for the six months ending December 2022 due to the impact of the coronavirus pandemic.

The company’s overall turnover declined by 25.8 % compared to the same period last year because of reduced publishing orders, as advertising, circulation sales and publishing revenues declined by 3.15%, 12.5% and 77.71% respectively, while Commercial Printing revenue registered a growth of 29.9%.

Radio advertising, television advertising and print advertising revenue declined by 23.20%, 4.53% and 2.86% respectively from the same period last year.

Cost of sales decreased by 31.77% due to a reduction in the volume of business while Administrative expenses increased by 10.02% due to increased costs of running the business, particularly fuel and transportation costs.

“The company remains resilient with high business potential in new ventures in publishing and packaging. Focus on traditional media business will be maintained,” the company executives said.

“Management is keen to increase efficiencies and expects to conclude the Financial Year 2022/23 with a much better outcome.”

Cigarette dealers, British American Tobacco Uganda (BATU) recorded a subdued profit after tax from Shs 10.2bn to Shs 9.8bn last year on account of increased illicit cigarette inflow.

BATU Managing Director, Mathu Kiunjuri, said whereas the business had remained resilient, the escalating trade in illicit tobacco products had become worryingly higher, growing from 24% to 29%.

Drugs manufacturer, Cipla Quality Chemicals Ltd, is yet to release its full-year earnings. However, it posted a remarkable 393.14% growth in profit after tax to Shs 13.86bn for the first half of 2022, underpinned by reduced production costs.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price