Kenya is witnessing a surge in remittances from its citizens in other African countries, highlighting the economic impact of intra-African migration. This trend gains significance as European remittance hubs face severe inflation. Experts attribute the rise in intra-African remittances to digital innovation and a growing network of money transfer avenues.

SPECIAL REPORT | BIRD AGENCY | Remittances from Kenyan migrants living in other African countries have become one of the fastest growing sources of diaspora funding for Kenya. This trend signifies a significant rise in intra-African migration, as Africans increasingly seek opportunities within the continent.

According to the latest data from the Central Bank of Kenya, remittances from within Africa have surged by a remarkable 42% between January and July 2023, compared to the same period last year.

In the first seven months of 2023, ending in July, Kenyan expatriates in Africa sent a total of US$164 million back home, surpassing significant regions like the EU, which sent slightly over US$149 million during the same period.

Despite remittances from America (US $1.4 billion), Europe (US $430 million), and Asia (US $338 million) being higher in volume during this period of assessment, CBK data has noted that remittances from African countries to Kenya are growing at a faster rate than those from any other continent.

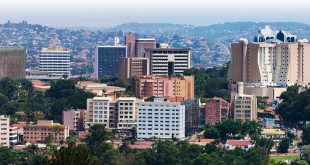

Notably, remittances from Tanzania and Uganda were significant, exceeding US$37 million and US$35 million, respectively. South Africa, Zambia, Ivory Coast, and Nigeria also feature prominently among the top countries sending money back to Kenya.

Remittances from Uganda and Zambia have experienced substantial growth, with increases of 113.5% and 136%, respectively, during this period. However, there has been a drop of over 50% in critical remittance hubs like South Africa.

As Western economies grapple with inflationary pressures, impacting the ability of Kenyans in those localities to send money home, remittances from Africa are playing an increasingly important role in Kenya’s economy.

Kenya’s situation highlights the growing trend of intra-African migration, a significant development as countries work toward a unified African economy under the African Continental Free Trade Area agreement.

A 2020 UN report reveals that in 2019, more than 21 million Africans lived in a different African country, a significant increase from approximately 18.5 million in 2015. Intra-African migration is expected to continue rising, with 85% of African migration involving routine cross-border trade and travel, as reported by the African Center for Strategic Studies (ACSS).

Interestingly, ACSS data shows that 80% of African migrants have no desire to leave the continent.

Experts attribute the growing remittances to Kenya from within Africa to the ease of access to money transfer channels.

Amahle Mkhize, a fintech and digital strategist, explained that the digital economy has enabled Africans both within and outside the continent to overcome financial exclusion.

“In recent years, there has been a noticeable shift towards digital remittances, with mobile money and other digital payment platforms playing an increasingly significant role in facilitating transfers,” she said.

As a result, money transfer organisations and digital platforms are increasingly partnering to offer efficient funds transfer systems, with remittances flowing directly from senders to recipients, all from the convenience of personal devices.

The growth of traditional banks across borders has also helped ease money transfers. Kenya’s Equity Bank, fore example, acquired banks in four countries, including the African Banking Corporation in Zambia, in 2019, part of a regional expansion drive. The bank also has subsidiaries in Uganda, Rwanda, Democratic Republic of Congo, South Sudan and Tanzania.

Additionally, telecommunication companies have ventured into providing mobile payments and related financial services, further simplifying the process of remittances flowing into the continent and in individual countries.

“A combination of these developments has led to a reduction in the cost of remitting,” Mkhize explained.

Total remittance flows in the region increased by 6.1% last year, totalling US$53 billion, a trend largely driven by robust remittance growth in countries like Ghana (12%), Kenya (8.5%), Tanzania (25%), Rwanda (21%), and Uganda (17%) according to World Bank.

*****

SOURCE: Bird agency

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price