Nairobi, Kenya | THE INDEPENDENT | Interest rates on external debt are hampering efforts by African governments to harness their resources for the green energy transition.

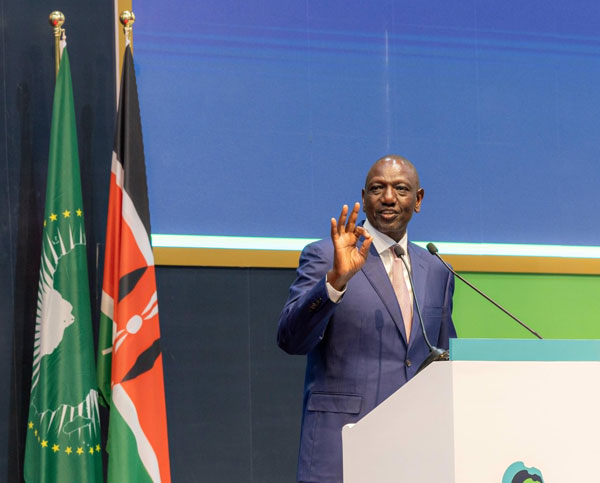

President William Ruto of Kenya said that while Africa is endowed with vast renewable energy resources, it is being limited by high-interest rates on development capital from the World Bank.

He said climate change and its disasters equally eating into the resources that should have helped the continent develop its economies.

Dr. Ruto was speaking on the second day of the ongoing Africa Climate Summit attended by over twenty heads of state and government.

Among those in attendance are Rwanda’s president, Paul Kagame, and Salva Kiir of South Sudan.

Ruto, the chairperson of the Committee of African Heads of State and Government on Climate Change (CAHOSCC) said Africa was paying five times more interest rates than others.

“They say figures don’t lie. Nine countries are already in debt distress in our continent. They are over the cliff, and 13 countries are classified as high risk. While 17 countries are classified as moderate risk,” Ruto said.

Ruto said Africa was not asking to be favored or to be treated differently, but asking for what he described as a fair financial system.

“We are asking for a fair financial system that treats everybody equally. That is not too much to ask,” said Ruto.

The Kenyan leader said many of the countries in Africa are headed to debt distress because of climate change.

“Let’s be honest we are suffering the most. Whether it is in the Sahel with drought, whether it is in the Horn of Africa with drought, or whether it is in Southern Africa with cyclones. And we are saying the suffering is global but we are carrying the biggest brunt”

The continent’s debt now stands at more than 70% of GDP. The public debt in Sub-Saharan Africa at the end of 2023 was estimated at one trillion dollars.

The IMF recently said that 13 African countries were on the brink of debt distress. Kenya which is hosting the summit was listed among the countries at risk of defaulting on their debt repayment. Other countries in that category include Malawi, Ethiopia, Chad, Egypt, and Tunisia. Twenty countries in Africa were at high risk or in debt distress.

The rise in debt is projected to increase a further 10 to 15 percent over the next three to ten years.

Speaker after speaker seemed to point to the fact that Africa contributes less to global warming but was suffering the most from climate change effect. The calls for debt justice also emerged. Some economists have found that every dollar that a government in the global south spends on repaying debt to its northern creditors, is a dollar that could have been spent on alleviating and preparing for the climate crisis.

Speaking at the summit, the United Nations Secretary General, António Guterres noted that African economies are being shattered by the effects of global rising temperatures yet it accounts for less than 4% of global emissions.

The UN Secretary-General, António Guterres said the people of Africa and everywhere need action to respond to the deadly climate extremes.

“And the largest emitters must lead the charge in line with my climate solidarity pact and acceleration agenda,” he said António Guterres who recently said the world has moved from global warming to global boiling.

“I make a very strong appeal to the large emitters, the G20 countries responsible for 80% of the emissions. Assume your responsibilities” said Guterres.

He suggested the need to address the injustices in the global financial systems so that they are more responsible to African countries.

Studies have found that debt service will take a significant share of government spending in Sub-Saharan Africa, with the average country spending 12 percent of government revenue on external debt service.

A study by the DRGR Project a collaboration between the Boston University Global Development Policy Center, Heinrich-Böll-Stiftung this week predicted that African countries will face debt servicing costs in US dollars that are roughly the same (93 percent) as their climate finance needs on an annual basis. That only ten countries in the region have the borrowing space to finance those needs.

****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price