Govt plans to boost economy by earmarking Shs 600 Billion in the next financial year specifically to capitalize banks and financial institutions

COMMENT | Caroline Kainomugisha | When the financial market is characterized by low financial inclusion, high-interest rates and therefore low investments and growth in the economy, one of the key solutions is to do what economists call capitalization. This is where financial institutions are given more capital to increase their capital base to be able to give loans to more customers in an economy.

Bank capital is a minimum requirement for a commercial bank or any other financial institution by a financial regulator. In Uganda’s case, the regulator is Bank of Uganda (BOU).

In this light, one understands why the Government of Uganda through Ministry of Finance, Planning and Economic Development, (MoFPED), has earmarked Shs 600 Billion in the next financial year as capital to a select number of Banks.

MoFPED intends to give Shs 484 Billion to Bank of Uganda, Shs 103 Billion to Uganda Development Bank, Shs 4.7 Billion to Post Bank, Shs 30 Billion to Housing Finance, Shs 600m to the Agricultural Credit facility, to mention but a few.

Now that government has already taken this strategic decision, I want to focus on what this decision taken by MoFPED means for traders along the value chain of production in Uganda’s Agriculture, Industry and service sectors.

A government may decide to fuel the economy’s engine by decreasing taxation, which gives consumers more spending power, or increasing government spending in the form of public investments such as building roads or hospitals etc.

By so doing, government creates jobs and wages that are in turn pumped into the economy hence consumers can then demand more goods and services. This creates a need for investment and spurs the growth of the private sector since consumers can afford to pay for the goods and services.

By earmarking Shs 600 Billion in the next financial year’s budget to capitalize banks and financial institutions, government has shown the direction it will take to boost the economy. To a bank/financial institution, capital is the value of its assets minus its liabilities. With more capital, the banks can offer more long term loans at a lower interest rate.

How will the small traders benefit?

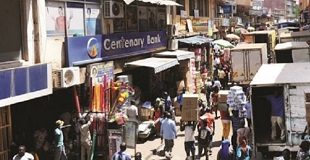

What does this mean for example to a one Mama Mboga who is a vegetable retailer in Nakasero market? Mama Mboga banks with a Micro Finance Institution (MFI) that can afford to lend small category unsecured loans to small income earners like her.

Monies set aside to capitalize MFIs will guarantee that Mama Mboga receives a cheap loan according to her history with the institute.

She will get flexible payment terms, which will help her to pay school fees for her children and maybe save some money to maybe build a small two-roomed rental house in Gayaza.

In being able to buy building materials, she directly supports a Hardware Business in Gayaza where she is constructing. The hardware is a bigger portfolio business probably banking with Housing Finance Bank and will also benefit from low-interest loans. This will help the hardware expand business to meet the growing demand for products from people like Mama Mboga.

In the same way, a one Mr Mukasa, a large scale vegetable farmer in Luwero that supplies Mama Mboga and others of can also access credit from the Agriculture Credit Facility.

This loan will help Mukasa to for example purchase an irrigation system and apply smart farming practices that will guarantee continuity of production, better and healthier yields and an escape from rain-fed agriculture.

Furthermore, Mukasa under the Uganda Agriculture Insurance Scheme (UAIS) can get protection against the effects of agricultural production risks.

UAIS is a public partnership between Government of Uganda and farmers aimed at protecting the farmers from financial losses due to damage and destruction of their crops and livestock resulting from; Fire, drought, lightning, earthquakes, explosions, uncontrollable pests and diseases, hailstorms, landslides, windstorms, malicious damage and flooding, etc.

With Shs 600 Billion earmarked in the next financial year’s budget for Capitalization of Banks, I have hope and confidence that the lives of Ugandans from the lowest person to the highest person will be improved through sustainable financial interventions. This fully in line with Uganda’s National Development Plan II priorities by supporting Small-Scale and Medium Enterprises (SMEs).

This should go a long way in alleviating poverty, creating jobs and sustainable livelihoods for not only the likes of Mama Mboga but all business people from different walks of life and backgrounds in Uganda.

*****

Caroline Kainomugisha is a Communications Assistant at Government Citizen Interaction Centre (GCIC), Ministry of ICT & National Guidance.

Caroline Kainomugisha is a Communications Assistant at Government Citizen Interaction Centre (GCIC), Ministry of ICT & National Guidance.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Well, that’s a good measure given the fact Uganda has faced a challenge of high interest rates that are sticky, is recapitalization the solution?

These high interest rates are a result of high government expenditure during the previous elections of 2011 and 2016 (check the trends of lending rates-B.O.U). Remember, whenever, the government borrows or reduces taxes, it all comes back to the people at a future date and the payment is in terms of high taxes, high interests on borrowing and the cycle continues. Anyway, since the target is mainly government owned banks there is also need to look at some other factors influencing high interest rates in those banks such operation costs because even if there is alot of money given to these banks yet having a big pouring out in terms of operating expenses, interest rates will remain high and this won’t help increase borrowing.

Once again, thank you Carol for the insights.