Period after lunch but before last hour of trading day is least preferred among all asset classes

Kampala, Uganda | RONALD MUSOKE | The first hour of the trading day is the most favoured time to execute trades globally, across all asset classes, according to a survey published on Aug.30 by FOREX.com, a subsidiary of the NASDAQ-listed Stonex Group.

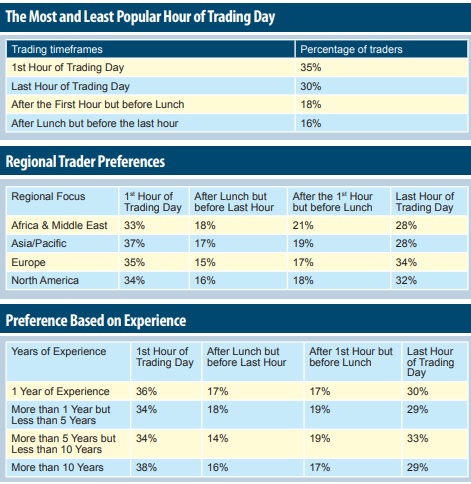

The survey which was conducted in July this year sought the views of about 3,000 experienced traders from across the world and it found that traders with the most experience are most likely to trade in the first hour of the day. Meanwhile, those with under 10 years of experience prefer the last hour of the trading day.

Across all asset classes (forex or foreign exchange, equities, commodities and bonds), the first hour of the trading day emerged in the survey as the most favoured time to execute trades globally. However, forex traders were particularly found to be inclined towards the first hour of the trading day above the traders of all other asset classes.

According to the survey, traders active in the Asia/Pacific markets such as Hong Kong, Singapore, Tokyo and Sydney are the most likely to place their trades in the first hour of the trading day, with 37% preferring this time to trade. On the other hand, European traders such as those in London, Paris and Frankfurt show a preference for the last hour of the trading day, with 34% of their trades executed during this time.

Long-term traders, whose preferred trading time-frame spans weeks to months are more inclined to execute trades during the first hour of the trading day. According to the survey, the findings align with the broader global trend, where most traders, irrespective of the asset class traded, favour the initial hour for trade execution.

Why the first hour matters

So, why do traders favour the first hour of trading to make decisions on whether they should trade or not? Matt Simpson, a market analyst at FOREX.com told The Independent via email that the first hour of a trading session can be the most volatile.

“This is when market makers are fulfilling their orders for clients and hedge funds are more likely to be active. This can lead to large price swings and increased risk for traders. However, it is worth noting that volatility is not always in harmony with market direction, so it is important to trade with caution during this time.”

“For example, it is not uncommon to see prices move in the opposite way to their intended direction after the London (Stock Exchange) opens. This can leave breakout traders susceptible to being sucked into a false move before the real trend of the day develops.”

On the other hand, the last hour of the trading day, Simpson told The Independent, can also be volatile, as traders may be squaring up their positions or taking profits.

“However, the price action in the closing hour will also depend on how the session has played out so far. For example, if the market has been trending strongly in one direction all day, it’s not uncommon to see prices retrace against that earlier move in the closing hour.”

Stephen Kaboyo, the Managing Director of Alpha Capital, a Kampala-based sovereign asset management, forex solutions and markets advisory firm also told The Independent on Sept. 5 that traders tend to prefer the opening hour because that is when the “market-clear-out” manifests.

Paul Bwiso, the Chief Executive Officer of the Uganda Securities Exchange agrees. “Forex moves at another speed and rate of liquidity but in the equities market where people put trades at the beginnings, they know what the closing price was the previous day, they have seen the available volumes and they also have orders. So, they are able to come and analyse the orders; these are the orders I had yesterday, and this is where the price is and I am able to execute certain trades,” he told The Independent on Sept. 6.

“During the course of the trading, the stock price is moving up and down, and the volumes are varying. There are those traders, especially day-traders who want to observe and see where the market is going; whether it is going up or it is going down and what volumes are available and they are likely to execute at the end.”

“Even here (on the USE), we have seen a lot of trades being executed in the last 10-15 minutes towards the end of the trading. Why? Because they have been able to see what’s in the market and are able to get prices for the stocks they want.”

However, David Calvin Bateme, a young man who has traded in stock on the Uganda Stock Exchange in Kampala over the last six years told The Independent on Sept. 6 the time of the day is not of so much importance to him.

“I will execute an order whenever it comes in; it’s not like that there are hot deals in the morning or in the evening,” he said.

“Unless an order comes in when it’s my bedtime and I am instructed to execute it in the morning, it would be hot for me. It’s a question of information and numbers moving. If the investors are bringing in their orders that quickly, we have to execute. There is no time of the day that is best for me to execute.”

How about trading during the rest of the day?

Still, the experience of the trader appears to influence the timing of trades significantly. For instance, traders who have plied their trade for over 10 years tend to trade in the first hour of the day, while those with five to 10 years of experience display a preference for the last hour of the trading day, with a notable aversion to trading after lunch but before the final hour.

The period after lunch but before the last hour of the trading day is the least preferred time for trades among all asset classes, with only 16% of traders selecting this time frame. Forex traders are least likely to trade after lunch but before the last hour of the trading day, suggesting a focus on early opportunity.

Simpson told The Independent that it can be beneficial to note the nuances of a particular market, as patterns come and go. “For example, I have noticed a tendency for USD/JPY to form an intra-day reversal around 10:45 – 11:00 AEDT (Australian Eastern Daylight Time) (20:45 – 21:00 Eastern Standard Time in Australia) in recent weeks, which is the end of the opening hour of the Tokyo session.

“It really depends on which economic calendar events are scheduled throughout the day or week as to when it is preferable to trade. A lot of US data is released in the morning between 08:30 to 10:00 NY time which can provide decent levels of volatility.”

“But the calendar can also be used as a deterrent not to trade, such as the hours leading into a big event such as a central bank meeting or inflation reports. Liquidity dries up ahead of large events which can make price action seem unpredictable.”

Simpson told The Independent that once an economic event has passed and the initial reaction is out of the way, a patient trader can seek lower volatility entries with more competitive spreads and avoid undesired levels of volatility.

Therefore, the economic calendar should be every trader’s guide to help plan their traders for the week, whether they trade the actual news or use it as a deterrent to trade.

“Aside from the daily timing patterns, traders should also consider seasonal trends. For example, the holiday season might see reduced trading volumes and increased market volatility, presenting unique opportunities for risk-aware traders,” said Michael Boutros, the Senior Technical Strategist at FOREX.com.

He added: “Additionally, geopolitical events and economic indicators can create fluctuations in global markets, demanding cautious and strategic decision-making.”

Boutros says diversification remains a cornerstone of successful trading. He says spreading investments across various asset classes and geographies, traders can mitigate risks associated with market fluctuations. “It also provides the flexibility to adapt to different time zones and take advantage of favourable trading hours in diverse regions,” said Boutros.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price