Surplus expected to eat into the producer’s profitability

KAMPALA, UGANDA|ISAAC KHISA| The cement industry in Uganda could be headed for tough times as firms increase production capacity next year beyond the available demand.

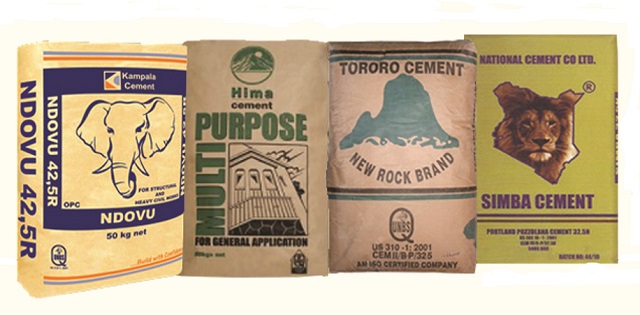

Lafarge Group’s Hima Cement is setting up a new plant in Tororo, eastern Uganda, with capacity of one million tons to boost its production to 1.8 million tons per annum.

Tororo Cement is also planning to increase its existing capacity from 1.9 million to three million tons, and Kenya-owned National Cement is spending US$185 million on a new one million ton per annum plant in the same region.

The new plants, which are expected to start production in the course of next year, will increase the country’s cement production from 3.6million tons to 6.8million tons per annum. But the current consumption stands at 2.4million tonnes annually and there are no clear new markets on the horizon.

Yet last year, a new producer; Kampala Cement opened a plant at Namataba, along Jinja-Kampala highway with the capacity of one million tons per annum.

Industry executives told The Independent in an interview that the expansion in production capacity is being driven by speculative growth to meet anticipated demand as government rolls out infrastructural development projects, including hydropower dams and oil and gas installations.

“Looking at the projection, we are going to have a construction boom once investments in the oil industry start and the subsequent oil flows. Towns are going to sprout up and more structures will be constructed,” Allan Ssemakula, the chief commercial director at Hima Cement says.

He says the succeeding infrastructural developments coupled with the increase in the construction of residential houses will boost cement demand. But he does not rule out a glut in cement production.

Currently, Uganda has allocated about 32% of its Shs 29trillion (US$8.08bn) budget for the FY 2017/18 towards development of energy and infrastructural projects including roads and railway.

Similarly, the country is looking towards the development of a $3.5bn crude oil export pipeline and a $4bn oil refinery ahead of the oil production planned for 2020.

Also, preparations for the development of other appropriate infrastructure including an international airport, a 500km road network within the Albertine region are underway.

Brij Mohan Gragrani, the CEO of Tororo Cement, last year said: “The expansion is proposed in view of market demand in Uganda and the neighbouring countries.”

Data from Uganda Bureau of Statistics shows that Uganda’s cement export earnings grew from US$94million (Shs337.9bn) in 2011 to US$106.8million (Shs383bn) in 2012, with majority of the products destined to South Sudan and the eastern Democratic Republic of Congo before reducing to as low as US$60.8millions in 2016 due to conflicts in the two states.

South Sudan descended into conflict in 2013 following a power struggle between President Salvar Kiir, and his former vice president Riek Machar, while eastern DRC continues to suffer sporadic attacks on civilians by various militias.

This comes at the time cement prices in Uganda are already falling from Shs33, 000 in 2016 to as low as Shs28, 000 per 50-kg bag at the moment, representing a 15% drop citing competition in the industry.

Latest studies depict an industry facing a clouded future as competition tightens. The main drivers are entry of new firms and expansion of the existing ones, a scenario that will result in price wars and possible fall in profit margins.

Also, imports from cement producers elsewhere in the region could also weaken Ugandan producers, with firms in Tanzania, Kenya and Ethiopia all investing heavily in scaling up supply. Already cheap imports continue to flood the region following the lowering of duty on cement imports from non-East African Community countries from 35 % cent to 25% in 2015.

Latest report by Dyer and Blair Investment Bank on the status of cement sector in East Africa shows that the current aggressive capacity expansion will result into the region’s capacity surplus leading to sub-optimal utilisation rates, hence rising operational costs and compressed margins among cement producers, especially given the price stagnation.

The report notes that with the increase in the number of cement firms from 16 in 2013 to 19 in 2016 across the region, the plant utilisations rates will fall from 61.7% in 2017 to 45.4% in 2018 on the back of increase in installed capacity.

So far, Hima Cement’s parent company, Bamburi Group, reported flat growth in its after-tax profit, citing falling demand in domestic and regional markets as well as rising competition.

The Nairobi Securities Exchange-listed firm recorded Kshs5.89 billion (Shs 204bn) net profit for the year ended December 2016, a 0.3% rise over the profit recorded during a similar period last year. The company’s turnover fell to Kshs 38 billion (Shs1.31trillion) from Kshs39.2 billion (Shs1.36trillion) in 2015.

Bamburi said the group had suffered due to lower demand for its products, despite having implemented cost-management measures in Uganda and Kenya.

“Overall, there was a marginal reduction in volumes into inland Africa export markets and intense competition particularly in the individual home-builder segment impacting prices in some markets,” the firm said.

However, Bamburi reaped the benefits of mega infrastructural projects in the region with rising demand from this market segment in Kenya, Uganda and Rwanda.

Tanzania’s Tanga Cement Company Ltd, which sells the Simba brand, saw its net profit halved to US$1.85 million (Shs 6.65bn) from US$3.63 million (Shs13bn) a year earlier citing entry of new firms and reduction in government spending on infrastructure development.

A different report released by AIB Capita shows that cement prices in East Africa dropped from an average of $140 (Shs 503,309) per tonne in 2011 to $100 (Shs359,506) per tonne in 2015 and further plummeted to an average of $80 per tonne last year, driven by Dongote Cement’s entry into the region.

The cement firm, owned by Aliko Dangote, one of Africa’s richest men, is using its factories in Ethiopia and Tanzania to gain a foothold in the regional cement market.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Dear independent.co.ug webmaster, Your posts are always well-written and engaging.