The 30-year old Stabilisation Measures ‘edict’ which required the government to finance its budget on cash basis must be abandoned immediately. It has been the origin of endemic corruption which has now become an epidemic. It is the origin of ‘short money’ which has led to the high interest rate regime of today. Cash is the most expensive medium of intermediation and is heaven sent for ‘rent seekers’ and other corruption-minded players.

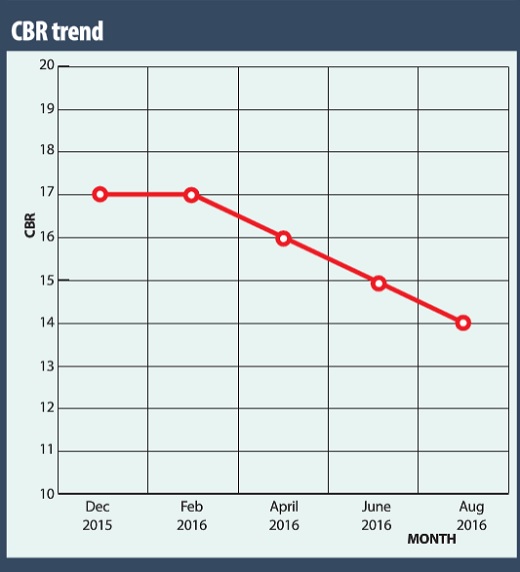

How can we say that the Uganda economy is a ‘B/B’ WITH A STABLE LONG AND SHORT-TERM OUTLOOK – and then have a ‘HIGH RISK’ CBR at 14% – a number which directly contradicts the Fitch and S&P country risk rating?

The third point to note is that the current Uganda interest rate regime is anti-middle income economy strategy – unless of course the strategy is fake and we are just looking to get oil on the surface and Uganda becomes mathematically a Middle Income Economy – but not in real terms; more like Equatorial Guinea and very messed up Venezuela which has the largest oil reserves in the world.

So the way forward : First we must conduct an independent value for money audit of all government and public institutions with a view to retooling them for domestic resource mobilisation i.e. Domestic Direct Investment [DDI] – and here I mean all institutions.

There is a detailed Capital Markets Industry proposal due to be presented to the Bank of Uganda under its moribund Financial Markets Development Plan [FMDP] – on how to grow domestic direct investment [DDI as a partner for the more popular foreign direct investment [FDI]. This proposal dates back to 2003 at the height of the now failed PEAP programs when the first PEAP reviews were looking for what is next beyond the otherwise ‘successful’ but jobless Economic Stabilisation Programs.

If this is ordered immediately, the World Bank Group will most likely immediately lower their guns and respond positively to the President Yoweri Museveni’s request for the lifting of the moratorium on new loans to Uganda because of the non-performance of previous disbursements.

The fact is that without DDI-centered domestic monetary and fiscal policy reforms, any new loans disbursed to Uganda on the current cash dominated and short term monetary and fiscal space will be like pouring water in the sand. In the end only the lenders will have a record of disbursement and Uganda will only have a non-performing debt to pay with zero medium to long term benefit. In any case, multilateral loans are typically first generation loans that are structured for stabilisation and not jobs growth.

Secondly, the monetary and fiscal policy reforms must have and include a 30-year monetary policy signal. Stabilisation economists do not understand such a longterm signal. But in the capital markets industry we do.

A 30-Year benchmark bond will redefine the financial services landscape – nearly flatten the current hump backed country yield curve, take the CBR to mid-single digits and for the first time give birth to a secondary markets trading and refinancing industry in Uganda.

While profit margins will become thinner, volumes will increase, as will the spread between interest rates and profit margins.

But most of all, life will become very difficult for rent seekers because financial instruments will increasingly replace cash.

Dr. Geoffrey A. Onegi-Obel is an Investment Banker and founder and Director of the Uganda Securities Exchange Ltd. He has served and sits on many Boards in Uganda and the region.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price