Kampala, Uganda | THE INDEPENDENT | Absa Bank has reinforced its position as one of the leading banks in Uganda after a record year that saw them hit a profit mark of over sh100billion for the first time.

Absa Uganda financial results for the year ending December 2021 released on Monday in Kampala show a rise by 169% of Profit After Tax.

Despite the effects of the COVID-19 pandemic, and a challenging economic

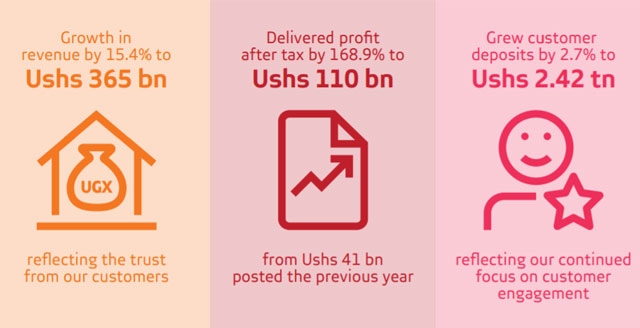

environment, Absa Uganda were able to turnaround the profitability of the business after a dip in 2020. They increased revenue by 15.4% to Sh365 billion and growing profit after tax almost three-fold year on year closing at sh110 billion, up from Sh41 billion posted the previous year.

“I would like to thank the Managing Director Mumba Kalifungwa for his leadership and congratulate him, his management team, and the entire staff on delivering a solid financial performance for year ending 2021,” Nadine Byarugaba,

Board Chairperson said as ABSA released its figures.

She then highlighted the other strengths that have enabled Absa to turn around their performance in a challenging economic environment.

“The pace of change brought about by the new normal, in a competitive landscape and evolution of client needs, dictates that we must keep developing attractive value propositions for clients, as well as developing our people to rise to the challenge. I am confident that Absa is well equipped to continue delivering on its strategy, manage risk, capital and liquidity, while supporting clients, employees, and communities to bring their possibilities to life,” Byarugaba remarked.

Managing Director Mumba Kalifungwa was confident that with the full re-opening of the economy, the bank will be able to build on the year 2021 performance.

“Our performance in 2021 and into this year, gives us confidence that we are on track to achieve our strategic and financial objectives. Following the full reopening of the economy early this year, we remain cautiously optimistic in the potential for growth and our sustained role as one of the leading banking partners,” Mumba Kalifungwa remarked.

“Looking ahead, we are mindful of the evolution of banking and trends shaping the financial services sector. Transformation in the digital era has been further accelerated by the pandemic as customers seek convenience.” Mumba Kalifungwa.

Bank MD Mumba Kalifungwa promised that “as Absa, we will continue seeking opportunities for collaboration while becoming more agile to serve customers beyond the boundaries of traditional banking. We will continue to invest in new technology to develop robust and attractive digital systems with analytical capabilities, and augmented intelligence which will generate levels of customer engagement and operational efficiency.”

Digital innovation

Absa Uganda has continued to pursue a strategic direction towards becoming digitally led, intending to leverage digital innovations to enhance customer experience.

The highlights in the past three years include the unveiling in 2019 of its first fully digital branch to offer customers greater convenience through self-service at automated digital platforms, including 24/7 self-service terminals for all cash withdrawals and deposits using intelligent ATMs, bulk cash deposits using the self-service bulk cash depositor, a variety of utility bill payments, interbank and international funds transfers, among others.

In 2020, the Novo FX app was unveiled, which allows Absa retail customers to seamlessly make cross-border payments across multiple currencies at a fixed foreign exchange rate up to the tune of sh100 million daily.

The latest innovations have seen the bank partner with MTN to introduce the mobile money payment functionality on Absa Point of Sale (POS) machines/terminals that was followed by the introduction of the country’s first cardless withdrawal function on Automated Teller Machines (ATMs), allowing customers to use a QR Code generated from the Absa Banking App on any smartphone device to withdraw cash at any Absa ATM countrywide.

READ FULL FINANCIAL REPORT SUMMARY HERE (CLICK ABSA_FINANCIALS RESULTS)

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price