On March 31 2016, the total value of all loans in Uganda’s commercial banking industry was Shs21.7 trillion of which Shs528 billion were non-performing loans (or “bad loans”) i.e. 2.64% of the total. Under the effective oversight of Bank of Uganda, especially its director for supervision; Justine Bagyenda (known in the industry as Uganda’s Iron Lady), non-performing loans have averaged 1.7% over the last 10 years. Although there was deterioration, it was a far cry from the 17% non-performing loans in 1996.

However, in just three months, nonperforming loans jumped three-fold to Shs1.8 trillion by June 30, 2016 representing 8.4% of total loans, an unheard of thing in nearly 20 years. What has caused this sudden deterioration?

It certainly cannot be bad borrowers and reckless lenders but something troubling about our economy generally. It is thus justified to fear the situation could worsen with bad loans reaching Shs7.0 trillion (30% of total loans) by December. This fear can be contested but for policy makers it is always safe to plan for the worst even when hoping for the best.

Most commentators have denounced the proposed bailout as a scheme to line the pockets of incompetent businesspersons, reckless banks, and “regime cronies”. But let us look at the facts for some perspective.

How to help distressed companies without removing the risk from lenders and borrowers

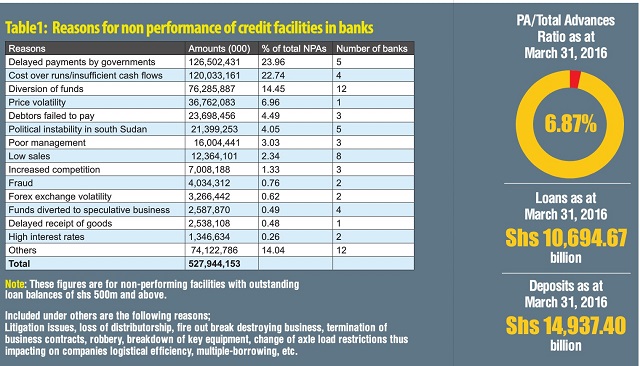

Of the Shs528 billion in non-performing loans, Shs126 billion (24%) is a result of government not paying domestic arrears to its suppliers. Diversion of funds to speculative businesses is only Shs2.6 billion (0.49%). See Table 1. Almost 30% of these loans went to building and construction (Shs155 billion), 29% to agriculture (Shs151 billion), 24% to trade and commerce (Shs127 billion) while only 1.4% (Shs7.4 billion) went to personal household stuff. See table 3.

So Uganda is caught in a Catch-22 situation. If it intervenes to help distressed companies or over-leveraged banks, it will create the problem of moral hazard. For example, out of Shs21.7 trillion in loans, only Shs1.8 trillion is non-performing. If the problem is system-wide, how come Shs19.9 trillion of loans are still performing?

But the threefold growth in bad loans since April means that it is highly likely many good loans could go bad. Yet helping distressed companies means rewarding failure and penalising those servicing their loans. And in helping the 8.4% who are distressed, you could be encouraging many in the 91.6% who are doing well to become lax and default in anticipation of a similar bailout.

Moral hazard is a core belief among free market ideologues and a real risk in such government interventions. Moralists seeking social equity would also reject any bailout. But ideological dogmatism and moral outrage are rarely a basis for sound public policy.

I was re-watching a documentary on the 2008 financial crash in America. Secretary to the Treasury, Hank Paulsen, made the same ideological mistake in regard to Leman Brothers, a US investment bank, and refused to bail it out with only about $50 billion and let it go bankrupt. But this caused shock on the stock market leading to the near collapse of the rest of the banking sector.

Eventually, the US government had to fork out $700billion to bailout banks infected by Leman’s collapse and $800 billion as a stimulus package to recover from the ensuing recession.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Businesses fail in Ug coz;

1.There is no specialization we tend to put our eggs in many baskets.we should always learn from Madvani group of companies e.g they have specialized in agricultural production.They have mastered this field thats why we never hear them complaining.

2.Most Business owners have no professional advisers e.g lawyers,accountants.

3.They r big time speculators.e.g how can one borrow heavily hoping that he/she will win a tender to supply machinery during oil production?

4.They have local swagg & competition e.g they can even decide to compete amongest themselves on who has fancy cars,who has a prettier woman.

5.There r many fraudsters in the business world actually at times they make lawyers look like fools in courts of law you find person x used the same land tiiles to secure loans in 2 different banks.

Businesses succeed when one;

1. Has passion and love for what she/he does.

2. Pays all his/ her expenses and suppliers in time.

3 .Has social capital please chill in places like golf clubs and 1st class hotels.

4. Is focused,has goals and targets not the Rajabs of this world who begin with packing tangawuzi & ends up dealing in babies’s clothes & shoes.

These are my views on the UBC Saga

1.Margaret is innocent coz she has neither worked for UBC nor did she initiate the sell of UBC land.

2.She is not a court bailiff.

3.Most judges just want to impress the public e.g auctions are only authorized by courts of law. The supreme court in its wisdom should have addressed itself to the confusion that arose from the lower court (they r one family)that okayed auctioning UBC land.

4.Most govt property have been sold to investors at a give away price.(the MPs should not feign ignorance) they are the ones who introduced goodwill thats why Bugolobi flats,Houses in Kololo have all been sold at a low price may be its coz most civil servants are still green when it comes to hot cash.

5.I just laughed when Kiryowa said they were planning to have a special land title for UBC as if he has never heard of fraud.

Kyoka Winnie. Do you sincerely believe Margaret had 11 Bn UGX in her house mbu after selling livestock and borrowing from other Muhangas? As for Rajabs, remember they thrive in black markets but not in respectable business practices.

1.10 billion is just approximately 250 million pounds(celebrities blow such cash on vacations in Riviera,Miami,Las vegas).I have seen Ugandans fund raise at wedding meetings e.g Omeros presents a list of items needed for his wedding including buying a suit for the groom(as if he can go to church naked ) What if Margaret has 20 rich friends who contributed 500million each wouldn’t they have raised the 10billion?

2.The last time i saw the UBC land in Bugolobi,there were plenty of monkeys by now they could be elephants in there.

3.I thought the land was up for sale meaning it could only be bought in cash or cheque.

4.All public land has been sold so what are they trying to save?

5.Ugandans are so accustomed to doing things the same way thinking its normal e.g every Ugandan thinks of going for Xmas holiday in the village(you may think there is something special in their villages)

6.Bugolobi is a prime area i personally would not be surprised if people got out of their way to contribute towards the purchase of this land.

7.Parliament/Ugandans have a habit of harassing the well connected people psychologically they feel they have really won a big battle.

8. I know the psychic of Ugandans they expected the sale to have been advertised(which is ok) then people bid(of course they r more comfortable with a European purchasing their land) All of us know the jokes in the procurement process in Ug(There will be a whistle blower, then IGG will halt the deal,then smart lawyers will have a field day in court; at the end of the day we shall be compensating guys who paid only bidding fees (we have failed to think thru this; its more cost effective for Ugandans to bash the well connected than reason well.

9. Come rain or sunshine we shall front the whites you envy and get back our land NEVER JOKE WITH RICH PEOPLE.

10.I looks like the elite are praying for Andrew to named in a scandal but they have failed this is not about Margaret its about Andrew (although indirectly

Andrew looks (not is) a cunning fox who knows and adheres to rule no. 11 (after the ten commandments) which says: THOU SHALT NOT BE CAUGHT and rule 12: IF CAUGHT DENY AND DENY and DENY. During the period of denying, a well connected lawyer or an understanding judge will render the issue null and void. So Winnie, since Hon. Margaret says she borrowed from relatives (obviously of means) and Andrew is a very close relative (of means) the probability is higher than 50% that he is among the lenders the Hon alluded to.

Agriculture is the backbone of all national economy because it is the only known career God gave to Adam. So when all this con-man chaldean economics brought about terminology purposely to confuse producers of wealth, we knew all along they would starve on their own artificial bubbles. Now even Mwenda is confused and holds two opposing opinions bailout and not bailout because being a modern economist, he is trained in con-man-ship and bubbling. So we go back to the basics:

1.Me I say with benefit of hindsight that the GOVERNMENT MUST BAILOUT THE DISTRESSED COMPANIES.

2. The directors/managers/owners should all be relieved of their responsibilities/property a la 1972 Gen Idi Amin style….and paid the value of the DEAD CATTLE that their distressed businesses have become. If they are in negative; follow them and their spouses home and auction their toys and let them cool off in Luzira.

3. Put a new team in charge and remember to include military overseers in every one of them. I say military because they are more manageable than these civil-rights spoilt brats calling themselves. Recent evacuation/rescue of people from South Sudan is a good example of how the military performs when the C-in-C barks; fast,and accurate and beyond expectations… for example the C-in-C told them to rescue Ugandans in peril but with initiative they rescued other nationalities too including whites,arabs and indians who we know cannot rescue blacks in distress ( read Rwanda 1994).

BACK to my opening remark about agriculture: We pastoralists who keep livestock on behalf of other non-pastoralists who see cattle as meat know more about husbandry than any degree holder whose performance in the field is laughable.

In a HERD, there are certain animals that are weak and lazy and who fail to graze in an extended formation because they are shoved by others. The HUSBANDMAN identifies them and beats the bullies off the lazybone but at same time directing the lazybone towards a secluded place for special diet on the side. This practice helps to level the ground and the lazybone also grazes to satisfaction. THis is a BAILOUT as opposed to the jungle law of survival of the fittest. with this explanation I here rest my case.