Advises Muhakanizi, Kasaijja: Read before you borrow

Keith Muhakanizi, the secretary to the treasury, appears to have mastered the art of passing the buck to his team of accounting officers whenever the question of the government failure to use borrowed money comes up.

In the latest melee, Muhakanizi finds himself on the spot again following revelations by Auditor General John Muwanga that government has failed to use Shs. 18 trillion it borrowed.

“You ask individual accounting officers why they are not absorbing this money,” he told The Independent in a phone interview, “I also don’t know but government is trying to address this problem. It is poor performance, and yes, it is very bad.”

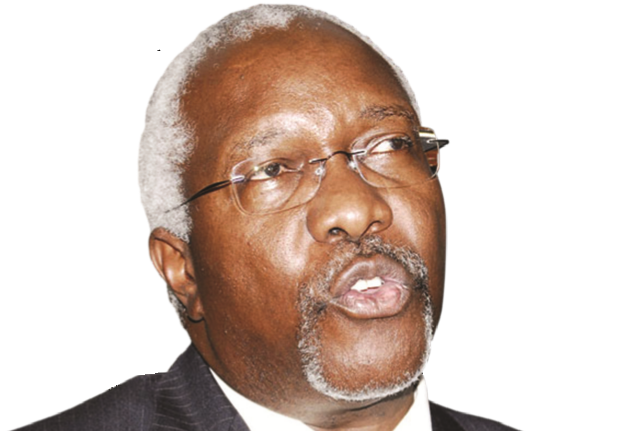

But former Finance Minister, Ezra Suruma, says this is not a new problem. “When I was minister,” Suruma told The Independent, “they (accounting officers and ministers) used to come with loans looking for signatures, I would ask them whether they had read and understood the conditionalities only to find that most of them hadn’t. I would ask them to go back and read and understand and they would say Suruma is slow.”

Suruma says a large number of loans is signed without prior and thorough understanding and negotiations by the borrowers. “As a result,” Suruma says, “officials cannot meet the conditionalities after signing and the lenders cannot disburse.”

Some of these loans require passing of new laws and as a result infringe on our sovereignty but most of the times the borrowers have not read and do not understand these conditionalities.

Suruma adds that what we need are committed people who can read and understand these documents (some of them as big as 500 pages) and sign them when they understand the conditionalities and can implement these projects.

“The problem is not that we don’t need the money,” Suruma told The Independent, “we need the money to implement all these development projects but we must get it after understanding the conditionalities behind it.”

This poor absorption has far reaching implications on Uganda. Muwanga has warned that that it undermines the attainment of planned development targets because the country end up paying more to the lenders in terms commitment charges.

The report on public debt (domestic and external loans), guarantees and other financial liabilities and grants for financial year 2015/16 submitted by Finance Minister, Matia Kasaija, to parliament in March last year, revealed that commitment fees paid on undisbursed funds have grown by 191% from $1.75m in 2007/2008 to $4.6m paid in 2013/2014 due to delayed implementation of projects.

Ever rising public debt has already raised concerns with many saying it’s soon hitting unsustainable levels. Debt has jumped from $1.9b in the 2008/2009 financial year to over $ 10 bn as of last year, according to Uganda Debt Network. Kasaija and his technocrats insist that at 34 percent of GDP, Uganda’s debt remains sustainable.

Apart from commitment fees, as public debt has risen, so has interest payments on it. In his budget speech last year, Kasaija noted that Shs. 2,022.9 billion was for interest payments on debt.

Muhakanizi promises

Muhakanizi has been promising to address this problem in vain. In the new report, the AG warns that some issues raised in the previous reports were not addressed by the accounting officers and insists that this time around, the new findings need to be addressed urgently.

Just last year, Parliament’s Public Accounts Committee (PAC) summoned Muhakanizi and his team over the same problem. At the time, the AG had just revealed that out of the 73 loans assessed by 2015, 15 were at zero absorption, while 58 were performing below 20%.

One of these is a $10million loan borrowed in 2009 from the Islamic Bank for the construction of urban markets in Busega in Kampala and Nyendo in Masaka district. By 2015 no money had been released despite the loan accumulating interest.

The other was funding for the Mutundwe-Entebbe transmission line, which was acquired by 2013 but in 2015, no money had been released.

Muhakanizi said that this project stalled because the conditionality was counterpart funding, which was not readily available.

Apparently, Shs500 billion had been allocated as counterpart funding but only Shs200 billion shillings was released.

Muhakanizi added that in other cases, things like a land title were a requirement, which takes a long time to get. In response, legislators wondered why government would borrow money before acquiring a title. Muhakanizi did not have a ready answer but he told legislators that despite these challenges, the political system keeps pushing too many projects to technocrats for implementation. PAC legislators were not convinced.

When PAC Vice Chairman, Gerald Karuhanga asked him whether he was proud of a legacy of being one of the worst performing governments with respect to loan absorption, he appeared apologetic.

“Kindly, honourable, did you hear in my voice where you felt that I am proud?” Muhakanizi asked rhetorically, “No no, I agree with you things are bad, we need to take action.”

At the time, President Museveni had also just talked tough over the matter in a cabinet retreat.

“Low absorption capacity?” Museveni asked rhetorically, “This not acceptable.”

But things continue to get worse. While the AG has always raised queries over the matter, it is the first time the funds in question are as high as the entire country’s budget. This year’s total budget is Shs.26 trillion but of this, funds available for spending are Shs 18 trillion.

The revelations show that the amount of unabsorbed funds has been rising over the years to Shs.18.1 trillion this year.

These revelations also contradict President Yoweri Museveni’s excuse that lack of funding is the major detriment to service delivery.

It appears now that despite having a high borrowing appetite, his civil service is failing to absorb these funds.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Every layer of bureaucracy initiated to curb malpractices means more hyenas to appease before a project starts. With no individual cost for such performance, the drive to do better is zero.